Whether you’re an expatriate sending money home, a freelancer billing clients overseas, or a small business paying international suppliers, fees and hidden markups can quickly eat into your bottom line. XE Money Transfer offers a straightforward solution: live mid-market exchange rates with transparent and low fees. Ready to maximize your savings? Sign up with XE Money Transfer today and start saving on every transaction.

In this guide, we’ll explore what mid‑market rates are, why they matter, and how you can leverage XE’s platform to cut costs on every international payment. If you want to dive right in and lock in the best rates now, create your XE account here.

What Are Mid‑Market Rates?

The mid‑market rate—also known as the interbank rate—is the midpoint between the buy and sell prices of two currencies on the global foreign‑exchange market. It represents the fairest, real‑time value of one currency against another, as determined by supply and demand among major banks and financial institutions.

When you see exchange‑rate data on XE.com or other currency‑data platforms, that is the mid‑market rate. Traditional banks and many money‑transfer services often add a markup—sometimes hidden—to this rate, pocketing the difference as profit. By contrast, XE applies only a small, clearly disclosed margin on top of the mid‑market rate, ensuring you get closer to the true market value.

Why Mid‑Market Rates Matter for Saving

- Eliminate Hidden Markups: Banks may add 3–5% on top of the mid‑market rate without telling you. Even a 2% markup on a $5,000 transfer costs $100.

- Upfront Transparency: XE displays your exact rate and margin before you confirm, so there are no surprises.

- Cumulative Savings: Frequent transfers magnify small differences. Sending $1,000 monthly with a 1% better rate saves $10 each time—or $120 per year. For a business sending $50,000 quarterly, a 1% improvement saves $500 per quarter, or $2,000 annually.

- Real‑Time Lock‑In: XE lets you hold a quoted rate for up to 24 hours, protecting you against market volatility.

How XE’s Pricing Structure Works

XE’s approach to fees and margins is designed for clarity:

- Flat Transfer Fee: A small, fixed fee (typically $3–$5) for transfers under a certain threshold (e.g., $1,000). Transfers above that threshold often carry no XE fee.

- Exchange Rate Margin: A transparent markup of approximately 0.5% to 1.5% over the mid‑market rate, displayed before you confirm your transaction.

- Third‑Party Bank Fees: Occasionally, intermediary or recipient banks may deduct a processing fee. XE can’t absorb these, but it will notify you if such fees are common for your chosen corridor.

By comparing the “Amount Received” figure rather than the headline rate alone, you’ll see your true cost and savings versus other providers.

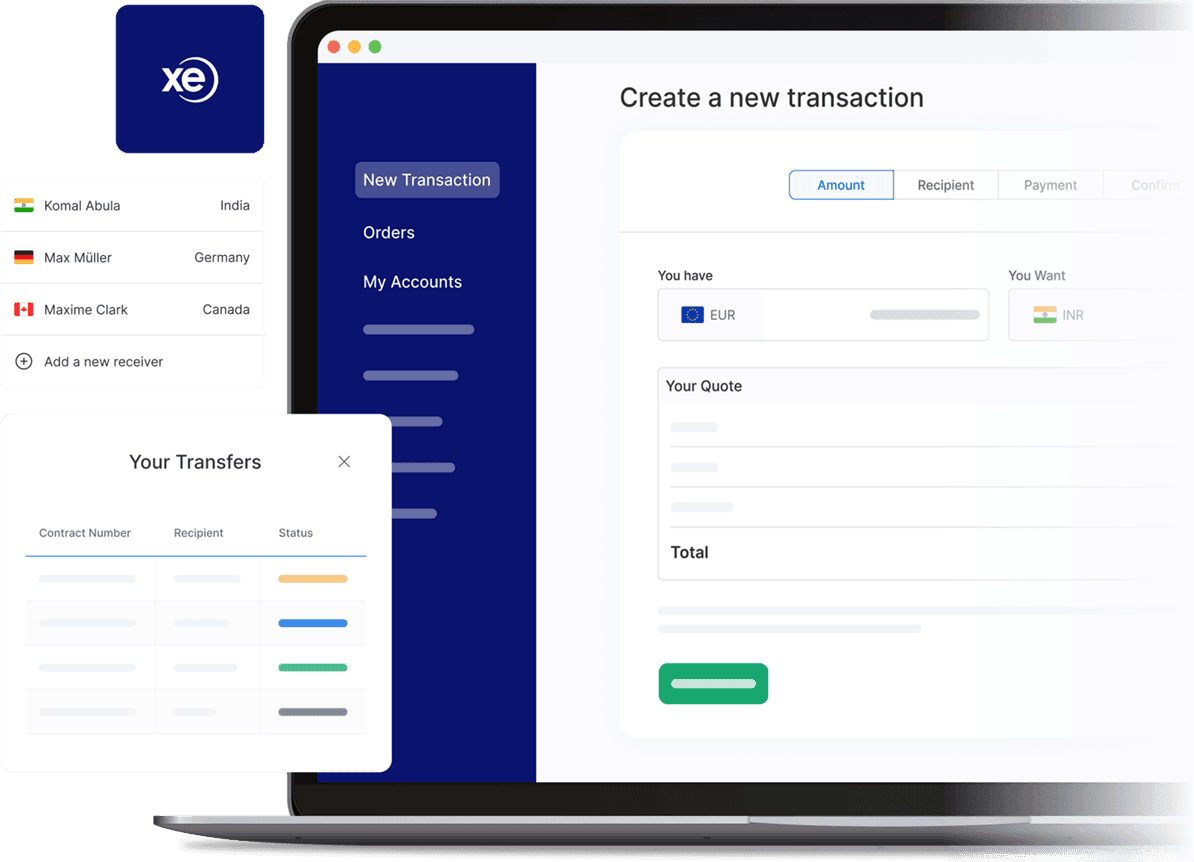

Step‑by‑Step: Using XE to Save on Every Transfer

- Open Your XE Account:

Visit XE.com or download the XE Money Transfer app. Register with your email and complete the simple identity verification.Time estimate: 5–10 minutes. - Get a Live Quote:

Enter the amount you wish to send and the destination currency. XE immediately displays the mid‑market rate, your margin, and the final amount the recipient will receive.Tip: Use the “Rate Alert” feature to monitor your desired rate and receive notifications when it’s reached. - Fund Your Transfer:

Choose your payment method—bank transfer (ACH/domestic wire), debit/credit card, or local payment rails like Faster Payments in the UK or SEPA in Europe.Note: Bank transfers generally have lower fees but take 1–2 business days to clear; cards are instant but may incur card‑network surcharges. - Confirm and Lock:

Review the exact amount, fees, and estimated delivery date. Click “Confirm” to lock in the rate, which remains valid for up to 24 hours. - Track in Real Time:

Use your XE dashboard or mobile app to monitor the status. You’ll receive email or SMS notifications until the funds reach your beneficiary.

Comparing XE to Banks and Competitors

Here’s how XE stacks up against other common options:

| Provider | Rate Margin | Fees | Speed |

|---|---|---|---|

| Traditional Banks | 3–5% (often hidden) | $10–$35 per wire | 2–5 business days |

| Wise (TransferWise) | 0.3–1% | $1–$3 | Same day to 2 days |

| Revolut | 0–1.5% | Free up to monthly threshold; then 0.5% | Instant to 1 day |

| XE Money Transfer | 0.5–1.5% | $3–$5 or waived | Same day to 2 days |

As you can see, XE’s combination of low margins, minimal fees, and fast settlement offers significant savings—especially on larger transfers.

Advanced Tips to Maximize Savings

- Batch Your Payments: Rather than sending multiple small transfers, consolidate funds into larger, less frequent transactions to minimize flat fees.

- Utilize Rate Alerts: Set target rates and let XE notify you when mid‑market rates reach your ideal level.

- Explore Currency Forward Contracts: For businesses with predictable payment schedules, locking in future rates up to 12 months in advance can hedge against adverse movements.

- Leverage Multi‑Currency Accounts: If you frequently receive in multiple currencies, use XE’s multi‑currency wallet to hold and convert funds when rates are favorable.

Security and Support You Can Trust

Saving money is only worthwhile if your funds arrive safely. XE employs:

- 256‑bit SSL encryption and regular security audits

- Segregated client accounts held in top‑tier banks

- Multi‑factor authentication and fraud‑monitoring systems

- 24/5 live chat, phone support, and a comprehensive Help Center

If you ever have questions or encounter issues, XE’s global support team is available to assist in over 100 languages.

Conclusion

Mid‑market rates are the key to unlocking consistent savings on international payments. With XE Money Transfer, you gain access to real‑time interbank rates, transparent margins, and low fees—all backed by bank‑grade security and responsive customer service. Ready to start saving on your next cross‑border payment? Sign up for XE Money Transfer now and take advantage of true mid‑market rates.

Don’t let hidden markups and excessive fees erode your hard‑earned money. Create your XE account today and experience hassle‑free, cost‑effective international payments.